How Attention-Based Models Outperform Traditional Bitcoin Fee Estimators

23 Oct 2025

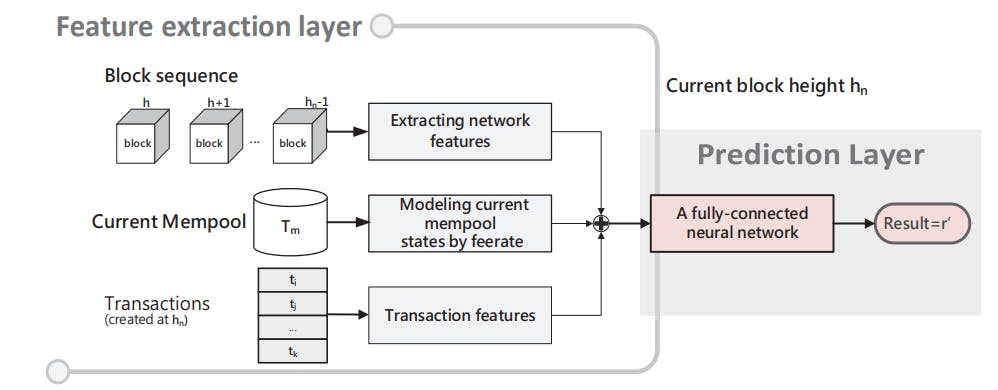

AI-powered FENN framework outperforms existing models in predicting Bitcoin transaction fees with higher speed and accuracy.

The Future of Crypto Transactions? AI That Predicts Network Congestion

22 Oct 2025

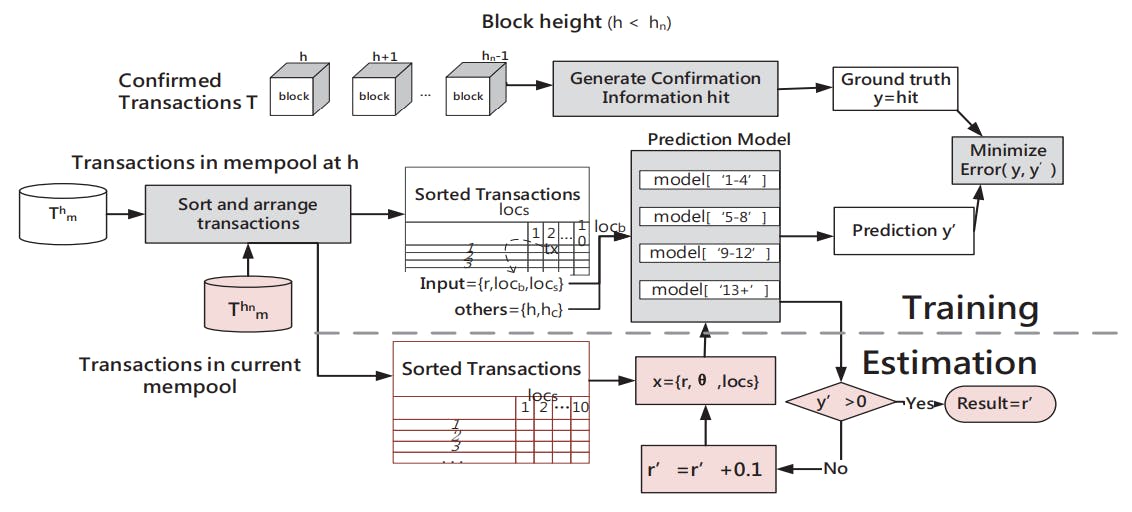

FENN uses deep learning to predict blockchain transaction fees by modeling mempool states, network speed, and transaction data.

Why Your Bitcoin Transaction Fees Might Soon Be Set by AI

22 Oct 2025

AI meets Bitcoin: Discover how the MSLP model predicts transaction confirmations using mempool data and neural network learning.

Inside Bitcoin Core’s Fee Estimation Algorithm

22 Oct 2025

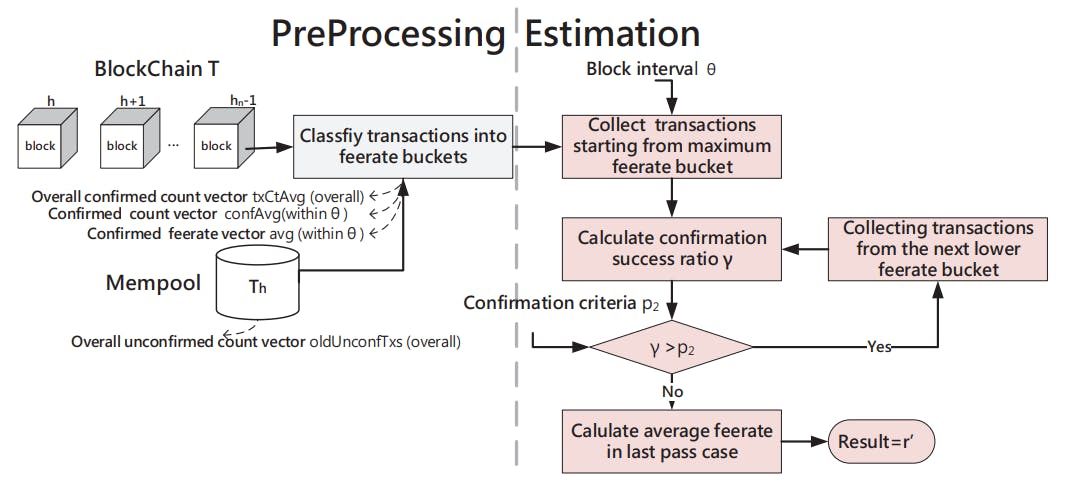

Bitcoin Core refines its fee estimation logic to make BTC transactions faster, fairer, and more predictable across multiple time horizons.

BtcFlow: Modeling Bitcoin’s Mempool Dynamics to Predict Optimal Feerates

21 Oct 2025

BtcFlow models Bitcoin’s mempool like a flow system to estimate the optimal transaction feerate for timely confirmations.

Estimating Bitcoin Transaction Fees Based on Confirmation Time

21 Oct 2025

Discover how Bitcoin miners set transaction fees, how mempools affect confirmation times, and what drives fee estimation models.

How AI Can Help You Avoid Overpaying for Bitcoin Transactions

21 Oct 2025

AI-driven framework FENN predicts optimal Bitcoin transaction fees in real time, improving accuracy and preventing overpayment or confirmation delays.

The Economics of 20% Yields: Staking, Liquidity Pools, and the Future of Saving

28 Sept 2025

Discover how DeFi staking and liquidity pools enable stable savings yields up to 20%—a feat traditional finance can’t match.

Can Blockchain Help Deliver Universal Basic Income?

28 Sept 2025

Exploring how DeFi, stablecoins, and radical markets could pave the way toward universal basic income.